Home Ownership Remains A Far- Fetched Dream For Millennials & Gen Z

On paper, millennials—people born between 1981 and 1996—and Gen Z—individuals born between 1997 and 2012—are projected to do better economically than their parents.

However, what’s on paper often fails to tell the whole story.

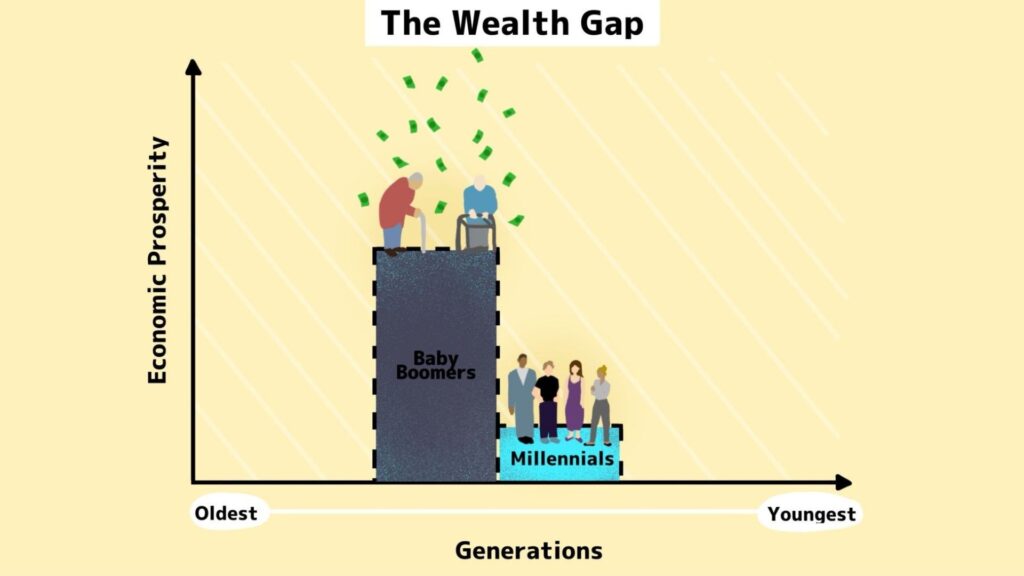

According to a report by the Federal Reserve Bank of St. Louis, younger Americans own $1.28 for every $1.00 held by baby boomers (adults born between 1946 and 1964) and Gen X (adults born between 1965 and 1980).

However, if you speak to young folks, you’ll likely hear about debt, economic hardship and a dwindling sense of hope for their financial future.

One reason for this is the stagnant minimum wage.

In 2023, the federal minimum wage was 40 percent less than the federal minimum wage in 1973 when adjusted for inflation.

This decrease in spending power has made it more difficult to achieve economic milestones, such as owning a home.

According to Rob Warnock, a senior research associate at Apartment List, an online marketplace for apartment listings, in 2019, the homeownership rate among millennials was 43 percent compared to Gen X—67 percent—and baby boomers—77 percent.

After the subprime mortgage crisis in 2009, down payments and lending requirements increased to avoid similar calamities, which made it more difficult to purchase homes.

A decade later, the coronavirus pandemic blew the doors of the housing crisis wide open, once again.

Between April of 2020 and April of 2021, the United States saw the average price of homes rise by 16 percent—the largest rise since 1992—with some areas seeing increases of up to 20 percent, according to data from the Federal Housing Finance Agency.

Since the federal minimum wage has stayed the same since 2009, owning a home has increasingly become farther out of reach.

Education, coined by Horace Mann as “the great equalizer,” has historically improved Americans’ economic outlook, as higher levels of schooling traditionally translated to higher levels of income.

However, the price of getting a degree has skyrocketed to absurd levels while wages have remained stagnant.

Shannon Insler, a personal finance writer who has written for outlets including Business Insider and Yahoo! Finance, provides some insight in an article for Lending Tree, an online lending marketplace.

“When millennials were born, tuition at public four-year colleges was just $3,190 per year (adjusted for inflation),” Insler said. “By the time they grew up and enrolled in college, tuition rose 213% to today’s cost of $9,970 per year.”

This has forced college seekers to take on student loans and increase their debt, which has hampered mortgage savings and caused many young Americans to delay starting families.

When assessing quality of life, wages, housing and education are interconnected. Until these disparities are addressed, it’s hard to envision a future where economic prosperity is a reality.