MDC To Provide Free Tax Preparation Services In February

Miami Dade College will be providing free tax preparation services at various campuses from Feb. 7 through April 13 as part of Miami-Dade County’s IRS Volunteer Income Tax Assistance Program.

The program is available to low-income, elderly and non-English speaking residents. It’ll be administered through MDC’s Miguel B. Fernandez School of Global Business, Trade and Transportation.

VITA will provide limited services through appointments at North, Kendall and Wolfson campuses. Each will have different operational hours. To get campus-specific information, visit https://www.mdc.edu/vita/ and select the campus of choice.

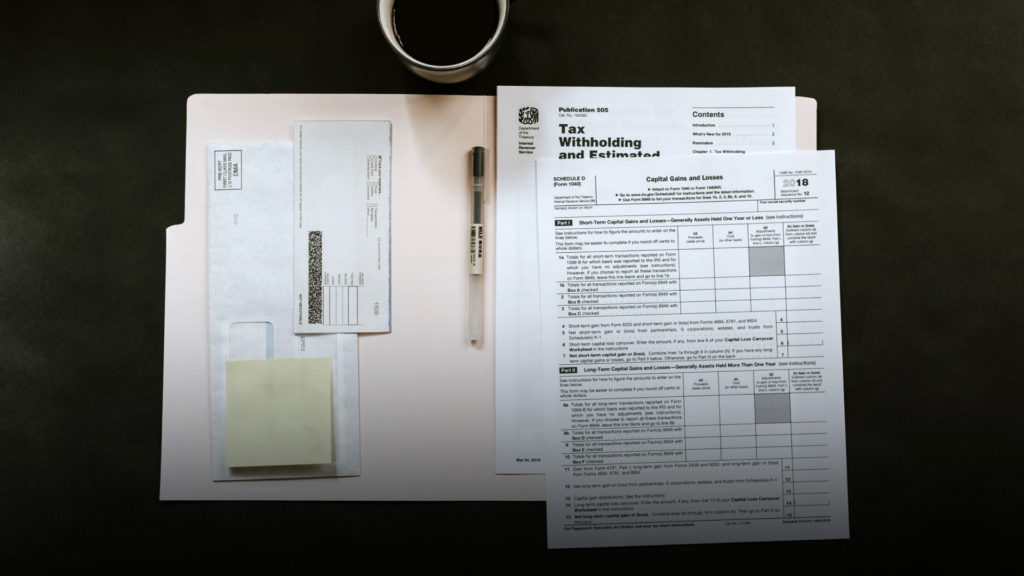

Individuals are required to bring their social security card and that of any dependents to be claimed, photo ID, W-2 earnings statement, 1099 MISC (for those self-employed) and 1099 INT (interest income) forms, 1098T tuition statement, 1095A health insurance marketplace statement, copy of last year’s federal return and any documents regarding the expenses to be claimed.

Federal Income Tax Returns must be mailed and postmarked by April 15.

In 2019, the College prepared 2,619 individual income tax returns thanks to this program. In its almost 30 years of service, VITA has generated more than $50 million in refunds.

For more information about the program, contact the Chair of the School Of Business Ana Cruz at (305)237-7139 or acruz1@mdc.edu.